Title loan proof of residence is a crucial requirement for borrowers seeking secured financial assistance. Lenders verify current place of living through official documents like utility bills, lease agreements, or property tax statements to ensure regulatory compliance and mitigate risks. This process fosters transparency and reliability in the lending environment, protecting both lenders and borrowers from non-compliance and fraud. Online application processes can streamline these checks, enhancing accuracy and speed while maintaining a trustworthy lending environment.

Title loan proof of residence (POR) is a critical aspect of regulatory compliance, ensuring lenders provide loans responsibly and protect borrowers. This article delves into the essential role POR plays in navigating the complex landscape of title loans. We explore why it’s crucial for lenders to verify a borrower’s residential status, how to implement effective checks, and the significant impact on both businesses and consumers. By understanding these dynamics, lenders can foster trust while adhering to regulatory standards.

- Understanding Title Loan Proof of Residence

- Regulatory Compliance and Its Importance

- Implementing Effective Proof of Residence Checks

Understanding Title Loan Proof of Residence

Title loan proof of residence is a fundamental requirement for borrowers seeking financial assistance through secured loans. This process involves providing documentation that establishes the borrower’s current place of living, ensuring regulatory compliance and facilitating the lending process. It serves as a critical step in verifying the borrower’s eligibility and helping lenders mitigate risks associated with emergency funding.

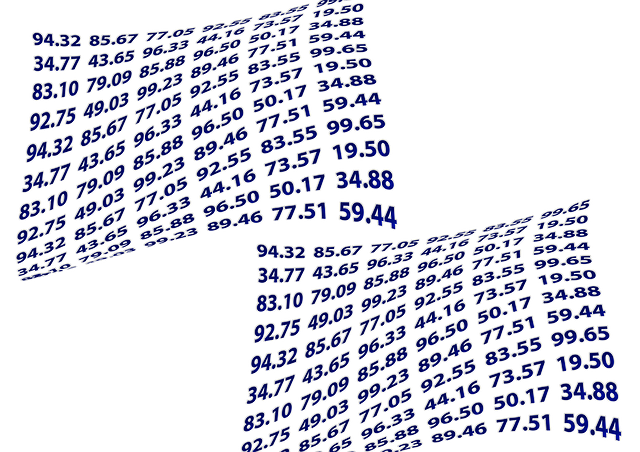

When applying for a title loan, individuals are typically asked to present official documents such as utility bills, lease agreements, or property tax statements. These items offer tangible proof of one’s residence and provide lenders with confidence in extending credit. By requiring this documentation, lenders can adhere to legal obligations and ensure they offer services within the boundaries of applicable laws, thereby fostering a transparent and reliable lending environment.

Regulatory Compliance and Its Importance

Regulatory compliance is a cornerstone in the financial sector, ensuring that businesses operate within legal boundaries and protect consumer rights. When it comes to title loan proof of residence, this aspect becomes even more critical. Lenders must verify not only the borrower’s identity but also their physical location to maintain a transparent and lawful lending environment. Failure to comply can result in severe consequences, including legal repercussions and damage to the lender’s reputation.

Providing valid proof of residence during the application process for title loans, such as Boat Title Loans or other secured loans, is a simple yet effective way to navigate these regulations. This documentation assists lenders in cross-referencing data, confirming the borrower’s eligibility, and facilitating a smooth title transfer. By adhering to these guidelines, lenders can offer much-needed emergency funding while maintaining integrity within their practices.

Implementing Effective Proof of Residence Checks

In the context of title loan proof of residence, effective checks are paramount to ensure regulatory compliance and safeguard both lenders and borrowers. One crucial aspect is verifying the borrower’s current and stable residency, which helps mitigate risks associated with non-compliance or fraudulent activities. Lenders can implement robust proof of residence procedures by demanding official documents such as utility bills, lease agreements, or government-issued IDs that reflect the borrower’s address. Additionally, cross-referencing this information with reliable databases can provide further validation.

For instance, an online application process for Houston title loans can streamline these checks by allowing borrowers to upload relevant documents digitally. This not only simplifies the procedure but also enhances accuracy and speed. By incorporating such measures, lenders ensure that they offer financial assistance to eligible individuals while adhering to industry standards and regulatory frameworks, fostering a transparent and trustworthy lending environment.

Title loan proof of residence is not just a bureaucratic formality; it’s a critical component for maintaining regulatory compliance. By implementing robust checks, lenders ensure that they operate within legal boundaries and safeguard against potential risks. This, in turn, fosters trust among borrowers and stabilizes the financial sector. As the digital landscape evolves, staying vigilant with proof of residence verification is essential to prevent fraud and ensure fairness in title loan transactions.